March 2023 may go down as the month that ESG had its moment. And the sudden headline attention – the massive sea of eyeballs now squinting at the term “environmental, social, and governance” – is both a testament to its worth and a case study in market demand outpacing product evolution.

Looking Back in Time

If we rewind to days of yore, we’ll recall that sustainable investing proponents have pursued higher visibility for decades. The goal was to elevate the discussion of the merits of sustainable investing overall because, when done right, it’s a smart way to deploy capital. It considers the risks of real-world change in the context of a broader business ecosystem rather than looking at the balance sheet alone.

ESG is a centerpiece of that approach, providing a more comprehensive view of how companies respond to issues that impact the organization. That said, it often fell below the radar. ESG is data. It’s analysis. It’s the dry underpinnings of an evolution in investment approach.

A New Paradigm

Now it’s as if we awoke in another dimension. ESG is popping up on the homepage of every news site. It’s the fulcrum of the entire conversation.

And while the debate (however muted) about ESG used to be focused on its effectiveness and necessary adjustments to ensure reliability, the primetime argument is about something else entirely. It’s about political agendas and false narratives that claim ESG seeks to dethrone capitalism, driven by a fairly transparent push by conservative-led states and organizations designed to preserve investment flows into fossil fuels.

The bad news? The discourse is full of confusing language and misinformation, in effect obscuring the real purpose of ESG.

The good news? The saber-rattling has finally elevated ESG to a national topic of interest.

The more good news? The widening discussion is accelerating more widespread education about ESG.

ESG in the News

Consider the mainstream media focus starting around March 1, when Congress sent a bill to Biden that would, in part, overturn previous legislation that allowed the use of ESG in retirement funds:

- USA Today, Biden plans to veto Senate’s ESG measure: What’s behind the GOP backlash against ESG?

- New York Times, The Escalating Battle Over E.S.G.

- CNN, Biden’s veto supports free markets, not ‘woke’ capitalism

- Economist, The anti-ESG industry is taking investors for a ride

- Wall Street Journal, Joe Biden Issues First Veto, Rejecting Attempt to Block ESG Effort

- Nerdwallet, What Biden’s ESG Veto Means for Investor Choice

The list goes on.

By the Numbers

I started working in strategic communications with an ESG bent about 15 years ago. Never have I seen ESG noted in more than a handful of mainstream publications in one week. In fact, a quick comparison of media coverage and sentiment shows the incredible surge of attention.

Consider that five years ago – pre-pandemic and in ESG’s formative years – ESG was mentioned about 637 times per day globally in the published media (February 1 – March 11, 2018).

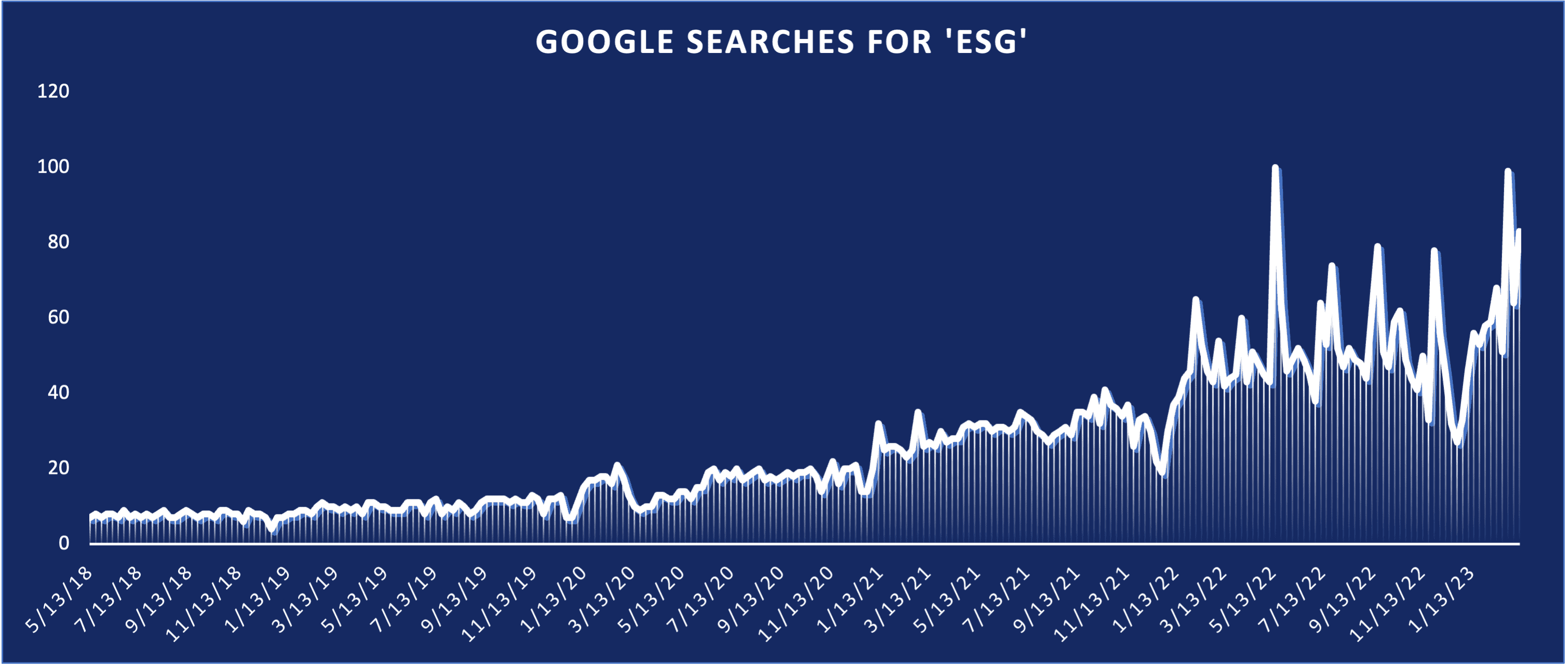

In 2022, those numbers jumped to 19,600 per day. And today? 24,100 per day. There are similar trends in online searches, which dramatically increased over the past five years.

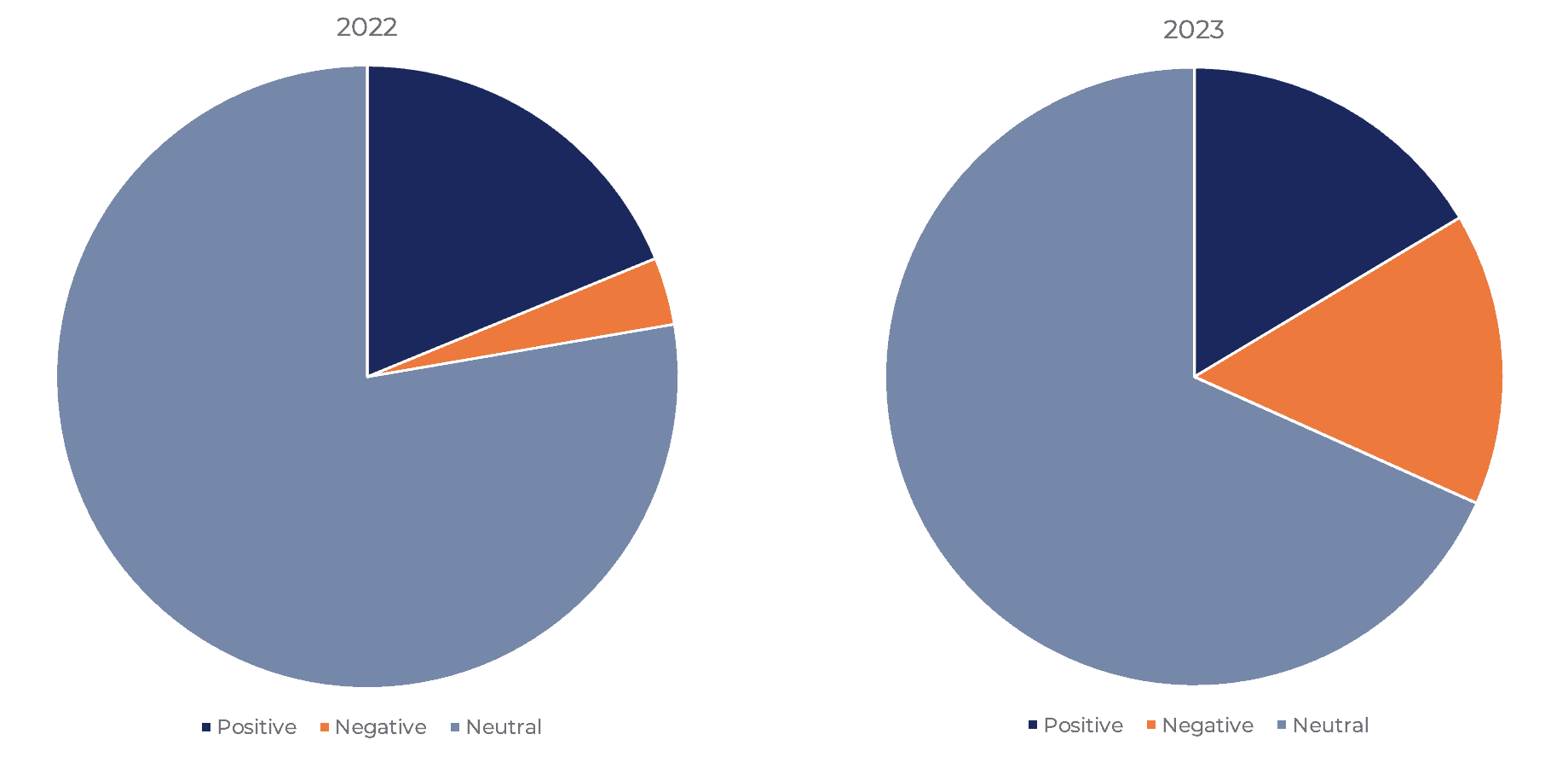

The sentiment evident in those mentions is also worth noting: in 2022, 18.8% of mentions were positive, and 3.5% were negative (the remaining were neutral). In 2023, 16.4% were positive, and 15.3% negative.

The trend is clear: the new voices are primarily detractors drawing from the previously neutral segment, while the supportive voices hold steady. Put another way; the negative noise isn’t convincing proponents that ESG is a problem.

Bringing the Noise

This is evidence of a boiling point. Detractors know that ESG is gaining in global popularity: 89 percent of investors considered ESG issues as part of their investment approach in 2022, and ESG is projected to hit $33.9 trillion in global assets under management by 2026.

Given that ESG, by its very nature, forces transparent responses to climate change and a transition to lower carbon energy, it was inevitable that popularity would force the hands of those who don’t benefit from the evolution.

Fossil fuel interests, in particular, fear significant outflows of financial and reputational capital. There are naturally more layers, but the upshot is that some very large, influential players found themselves cornered and sought a strategy to slow the wave of ESG adoption.

It’s a noisy strategy. There are valid concerns, with objections primarily based on misdirection that intentionally pairs ESG with fossil fuel “boycotts.” The most concerning false claim to gain traction is that ESG is a “secret” way for ultra-liberals to trick investors into sacrificing return potential in favor of environmental and social causes.

A New Strategy

The debate was one-sided until February. Then, ESG practitioners largely kept their heads down with the mantra “this too shall pass.” ESG was suitable for investing, and that was all that mattered. The largest financial institutions in the world simply tuned out the distraction and moved ahead with their due diligence practices.

However, when U.S. states began proposing anti-ESG laws, proponents seemed startled into action. Nearly all prominent global asset managers went on the record to defend ESG as vital to modern research. Politicians stood up in favor of ESG as a free market practice. President Biden used the first veto of his Presidency to ensure financial managers have the option to apply ESG to retirement plans.

This escalation may give detractors what they aim for a conservative ballot issue that appeals to their base, even if it’s lashed together by duct tape and false claims. It is not likely to eliminate ESG from investing or create a true legislative boycott. In fact, some states that passed or considered anti-ESG legislation are already backtracking; Arizona, Indiana, and Kentucky all made clear that “outlawing” ESG was not in the best interests of their constituents.

As the noise reaches a fever pitch, however, there are side effects. The burst of media attention is driving greater awareness, and the hope is that investors will learn more about what ESG really is – even if it’s through an ugly discourse.

The application of ESG isn’t perfect by any means, and it’s widely accepted that there need to be universal standards and metrics to ensure that everyone is reporting on the same playing field.

For now, those who have followed or applied ESG through the decades can take a moment and realize that the path to recognition is not what they charted. But it’s here. And it’s primetime entertainment.