The reason? The markets have finally caught up to what ESG and Corporate Social Responsibility (CSR) professionals have been saying for years. This information is financially material, and stakeholders care about it.

How Did We Get Here?

Historically, evidence supporting this has been disjointed and slow. For example, in 2010, the Johannesburg Securities Exchange required its constituents to adopt Integrated Reporting adhering to the International Integrated Reporting Council’s standards.

Furthermore, sustainability reports following the GRI framework have grown exponentially year-over-year, with more than 10,000 companies worldwide reporting — not to mention 284 policies in 84 countries that reference the GRI.

We know: all well and good, but that’s not the reason you are reading this blog or why this has rocketed up the corporate agenda. The world’s largest economies are acting. Both the US Securities and Exchange Commission and the Stock Exchange of Hong Kong Limited (HKEX) have proposed rules requiring climate-related disclosures.

The former’s directive is expected in the Fall, whereas the timing for the latter is a bit less clear. And the “Big Kahuna” is the EU’s Corporate Sustainability Reporting Directive (CSRD). The directive was issued on April 21, 2021, and now is when the rubber meets the road. Companies within the EU, US, and elsewhere will have to report based on the European Sustainability Reporting Standards (ESERS) if they wish to continue operations or sell products and services in the region.

The International Accounting Standards Board’s International Financial Reporting Standards Foundation has also released its first two sustainability-related disclosure standards, IFRS S1 and IFRS S2. While the International Sustainability Standards Board decided to introduce one-year transition relief for reporting entities, IFRS S1 and IFRS S2 are effective for annual reporting periods beginning on or after 1 January 2024.

Sick of Alphabet Soup?

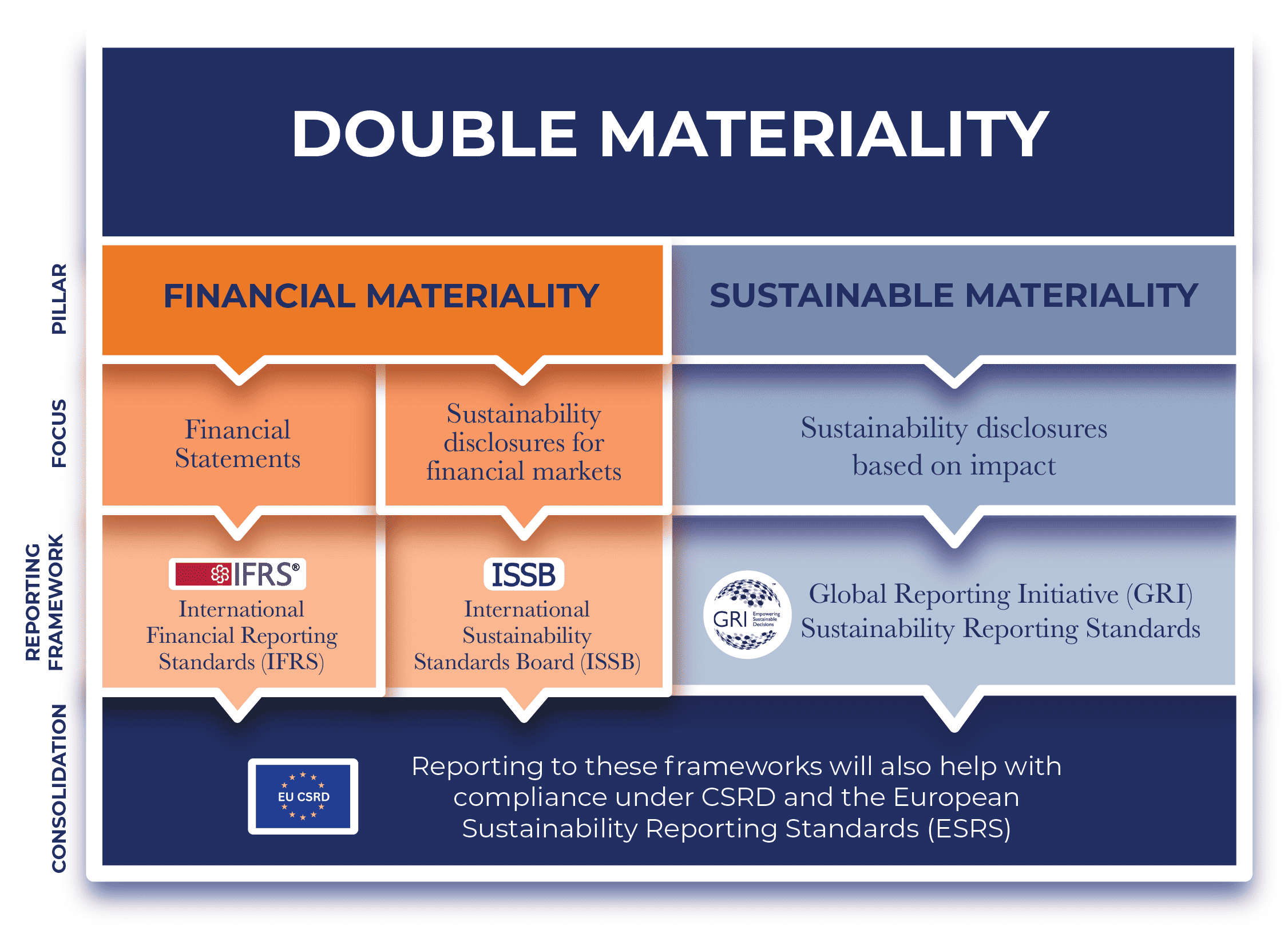

Are your eyes crossed by all the acronyms? You’re not alone. One of the enduring knocks against sustainability and climate-related disclosures has been fatigue and confusion about which frameworks or organizations to report to.

For those who are simply trying to figure out where to start, the process can be exhausting. The list of frameworks and organizations above is only a small piece of the bigger picture.

You can learn more about that picture and get started with Sustainability Reporting and ESG Communications in our recent paper, here: Sustainability Reporting & ESG Communications

In the meantime, here is our cheat sheet:

The good news about the recent developments on the sustainability reporting and ESG disclosure front is that we are finally starting to see consolidation and consistency. The standards and frameworks are focused on the notion of double materiality – how is the company impacting the environment and societies around it, and how are these externalities impacting the company, particularly from a financial performance perspective. The important thing to remember is, everything is based on this “two-pillar reporting” system.

The organizations and standards you use to achieve this two-pillar structure are where it gets a bit more confusing, but we are always here to help. If you have questions or would like to learn more about working with us, please reach out.