While momentum has been building for years, the link between company performance and Environmental, Social and Governance (ESG) ratings has never been so clear. The convergence of major issues – COVID-19, climate change, and diversity, equity, and inclusion have all emphasized the reality that corporations that hold ESG as an integral part of the business are managing risk and opportunities on a higher level.

Of course, ESG goal setting and reporting are crucial. Companies need to understand what to measure, how to measure it, and how to articulate their ESG journey. KKS Advisors and Longview are collaborating to provide greater clarity around their corporate social and environmental sustainability programs.

An early step? Identifying what ESG factors are material to the business, and how to track progress. Below are more thoughts on the materiality assessment process from Guest Contributor Anuj Shah, Managing Director, KKS Advisors.

Material Topic Identification

A materiality assessment is the process of identifying, refining, and assessing the numerous potential environmental, social, and governance issues that could affect a business and/or its stakeholders. Once identified, material issues are condensed into a short-list of topics that inform company strategy, targets, and disclosures/reporting.

The materiality assessment process at KKS Advisors consists of the following sequential steps:

Phase 1:

This phase entails leveraging frameworks such as GRI, SASB, TCFD, and <IR> to identify relevant material issue topics based on a company’s sector, industry, geography, and size. In addition, companies should leverage additional sources of information such as their business management teams, analyst reports, ESG ratings, media reports, internal data, feedback from investors, regulatory issues, peer reviews, and sustainability rankings to source additional materiality topics. The goal is to create a long list that includes areas of opportunities and risks and is pulled from a wide variety of sources.

Phase 2:

Once an initial materiality issues list is produced, topics should then be grouped into a limited number of categories that reflect a similar level of granularity. Group names should be aligned to a company’s strategy; group descriptions should utilize company terminology and reflect how the company perceives each group.

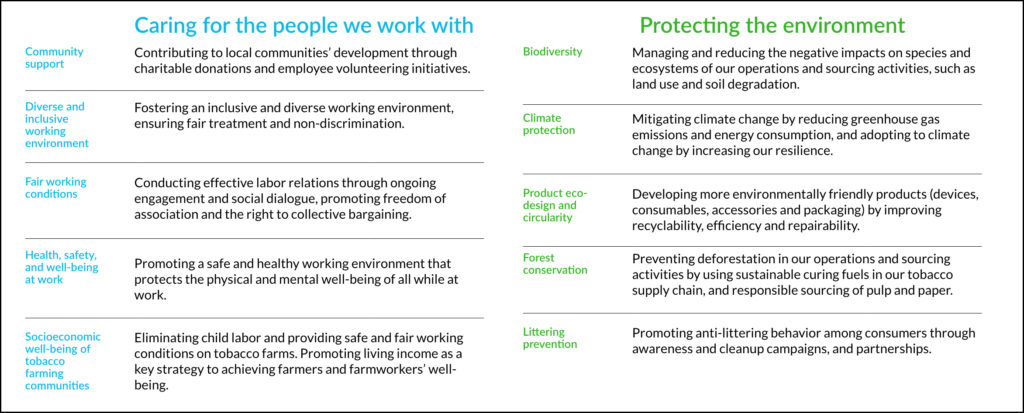

Sample Material Topics Framework

(excerpt from Philip Morris International Sustainability Materiality Report)

Phase 3:

After categorizing/grouping, additional information is gathered to better understand the relevance of materiality topics to both internal (business) and external stakeholders. A scoring methodology is defined to allow stakeholders to assess the impact and importance of each topic. For example, the methodology may ask stakeholders to consider how critical each materiality topic is to business strategy, risk management, and/or value creation.

Phase 4:

In this phase, materiality topics are prioritized by identifying the key business functions and external stakeholders that should be involved in providing feedback in Phase 5. Business stakeholders should be knowledgeable of firm-wide business strategy and senior enough to provide meaningful insight. External stakeholders may include individuals from civil society, the media, customers, suppliers, regulators, and the local community. Consideration must be given to the importance of each stakeholder group through their weighting i.e., how many individuals from each group are asked to participate in the process of prioritizing the materiality topics.

Phase 5:

Feedback from stakeholder groups is solicited through interviews and surveys. There is no limit to the number of participants, but consideration should be given to how to best generate detailed insights into the relevant topics. This will likely include both survey questions asking participants to prioritize topics as well as open questions allowing for more qualitative descriptions. Once responses are received, different weights may need to be applied in order to ‘smooth out’ uneven stakeholder representation arising from differences in response rates.

Phase 6:

Once the surveys have been completed, the results are analyzed to identify the company’s “most” material topics overall and by stakeholder group. The output(s) from this phase vary across organizations, but a materiality map or matrix has become the standard best practice to provide a visual representation of the priority/relevance/significance of material topics to stakeholders.

Sample Materiality Map

(Vornado Realty Trust, ESG Materiality Assessment from 2019 ESG Report)

What comes next?

With materiality as the underpinning, companies can build out a reporting and communications program that speaks to all stakeholders: employees, customers, analysts, and investors.

To learn more, contact us or download our Sustainability and ESG Reporting Guide.