As climate change continues to impact our world in breathtaking ways, solutions capable of combatting it are in high demand.

We need solutions that both ecologists and economists can get excited about. For ecologists, campaigns need to make material progress toward greatly reducing our greenhouse gas (GHG) emissions. And for many economists, progress shouldn’t come at the expense of free market principles.

Today, more nations and institutions are embracing a solution that takes a stab at appeasing both ecologists and economists: carbon credit trading. Carbon emissions are often found at the center of climate discourse and disclosures, as they are a measurable unit for determining an entity’s environmental impact.

Carbon emissions are pushing our planet to the brink of destruction. Unless we dramatically reduce our output, global temperatures will continue to rise past the Paris Climate Agreement’s 1.5ºC warming threshold.

In fact, to illustrate just how off-track we are, a 2022 report from the UN-backed International Panel on Climate Change (IPCC) found that countries’ financial flows are three to six times lower than what is needed to limit warming to below 2ºC.

But what are carbon credits? And can trading them really turn into tangible progress toward avoiding this fate?

The 411 on CO2 Credits

The idea behind carbon credit trading is simple enough: companies or countries utilize a carbon market (in many ways similar to our stock markets) to purchase carbon credits from entities that curtail greenhouse gas emissions.

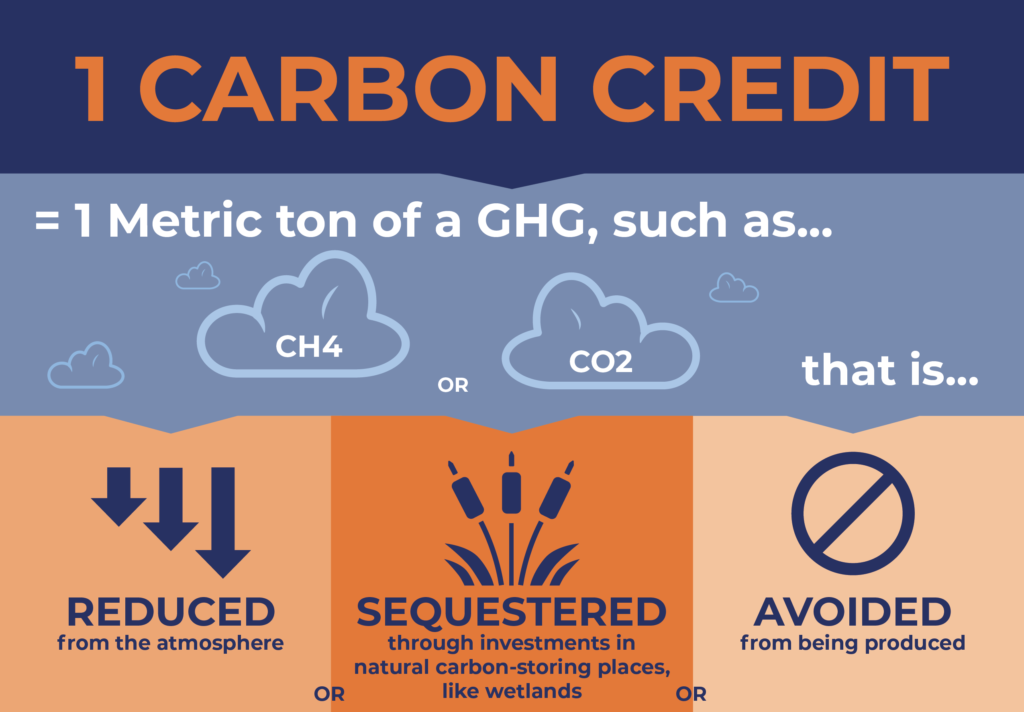

A carbon credit itself is equivalent to one metric ton of a GHG, like carbon dioxide (CO2) or methane (CH4), that is reduced from the atmosphere, sequestered (through investments in natural carbon-storing places, like wetlands), or avoided from being produced altogether.

Broadly, there are two kinds of carbon markets in practice: compliance and voluntary. Let’s dive into each to better understand their key differences.

Compliance Carbon Markets

Unlike voluntary markets, compliance markets are formed as part of national, regional, or international policies or regulatory mandates.

For example, a company may be required to offset their emissions to be compliant with their state of incorporation’s environmental laws.

Compliance markets themselves can come in different varieties, too. One such market is the Clean Development Mechanism (CDM), which was created as a result of the 1997 Kyoto Protocol.

A CDM allows countries to invest in emissions-reducing projects in developing countries, with the investment’s maturity producing carbon credits. A UN report on CDM’s effectiveness between 2001 and 2018 found that 7,803 projects in 140 countries reduced nearly 2 billion tons of CO2 emissions in the developing world.

Now, let’s look at the compliance market’s more laid-back cousin, voluntary markets.

Voluntary Carbon Markets

Voluntary carbon markets, deployed both nationally and internationally, involve the voluntary exchange of carbon credits through issuance, purchase, and sale.

Most voluntary carbon credits in circulation originate from private entities engaged in carbon project development or governments implementing programs certified by carbon standards. This voluntary engagement results in emission reductions, sequestrations, or avoidances.

Demand is primarily fueled by private individuals seeking to offset their carbon emissions, corporations with corporate sustainability goals, and various players looking to trade credits for profit at elevated prices.

These exchanges can be legitimized by independent (and internationally recognized) credit accounting standards. For example, the Verified Carbon Standard (VCS) is the most widely used guideline.

Voluntary market participants can use the VCS to vet their credits and eventually create a verified emissions reduction (VER), in a sense, an iron-clad receipt that proves your GHG goods are legitimate.

That’s how voluntary markets should function. However, as we will explore now, certain footholds in the industry aren’t playing by the rules. Any climate solution’s strength always boils down to the standards (or lack thereof) in play.

Criticisms of Carbon Trading

Like every climate solution, carbon credit trading is not free from the dangers of misuse. In fact, some would argue that voluntary carbon credit trading is a breeding ground for greenwashing and climate action pervasion.

Some actors have used the carbon market framework to hail the tremendous progress in reducing emissions, either within their carbon footprints or through investments abroad. Unfortunately, many of the loudest claims have proven to be far from the results claimed.

This year, researchers at the University of California at Berkeley explored a major source for carbon credit activity: forestry projects (which account for 11% of all carbon offsets ever issued). Specifically, the researchers explored projects that aimed to improve forest management.

Credits were generated from reforming harvesting practices and curtailing unsustainable logging industries. However, the Berkeley team found that many of these “projects” fell far short of promised (and reported) results. In some cases, no tangible progress was ever seen despite full issuances of credits.

The root of the problem? A major corruption of voluntary market standards, where credit issuers prioritized profits in lieu of climate progress.

Voluntary markets are propped up by groups that host independent registries. Within these registries are standards associated with credit issuing, which the hosts benchmark. Since these groups generate revenue by issuing credits, their business model inherently promotes a more lenient hand than a stringent one.

If a registry tightens its standards, its customers can pivot to another, less conservative credit issuer. As a result, as time goes on, standards become less rigid and less effective at determining verified emissions reductions.

Where we go from here

Despite these concerns in the voluntary markets, carbon credit trading is still being embraced in a big way by the international community. Just this past month, Asia giants India and Indonesia committed to integrating carbon credit trading into their long-term environmental transition plans.

The biggest takeaway from our analysis should be that carbon credit trading can be a tool for countries and organizations to take stock of their emissions and reveal pathways toward reducing them. However, this can only be accomplished when internationally recognized standards are followed.

Therefore, as has been the case during these past five years of gradual, global sustainable finance adoption, a unified front for standards needs to be prioritized. Otherwise, as we’ve seen with California forestry projects, entities will continue to use this fractured model to their benefit and continue to champion misleading, meritless “climate progress.”

And no, regulation doesn’t need to come at the expense of the free-market principle that many rally behind in carbon credit training. Rather, regulation will bring increased governance to these credits and strengthen the market on the whole.

Communicating a path forward

As we explored in our previous blog with similar sustainable finance campaigns like debt-for-nature swaps, “race to net zero,” and corporate climate disclosures, strategic communications play a vital role in carbon credit trading.

These professionals will be on the frontlines to educate the C-Suite on why vetting carbon trading standards is critical to business success. Stakeholders will need to be assured that your carbon credits are legitimate and how.

Moreover, communicators will need to be able to distill this complex industry into succinct messaging. Corporate sustainability campaigns underpinned by carbon trading will have to be defended. Closely adhering to standards will bear fruit as a key differentiator in sustainable finance, for with increased standards comes a major distinction between the players and the pretenders.

At Longview Strategies, we’re passionate about telling the stories behind corporate climate action. We know what’s at stake when damaging terms like greenwashing are on the table. If you’re looking to get on top of your climate disclosures or streamline your messaging, we’re on standby.