*Spoiler alert: it doesn’t matter. Here’s why.

What We Know

In March 2022, the Securities and Exchange Commission (SEC) proposed new rules for corporate disclosure concerning the risks and opportunities associated with climate change. The proposal is relatively consistent with the Task Force on Climate-Related Financial Disclosures (TCFD) guidance on such disclosure. It covers prospective risks and material impacts on business as well as the strategy and outlook caused by climate change.

The original proposal called on companies to disclose scope 1 (direct emissions from owned or controlled sources) and scope 2 emissions (indirect emissions from the generation of purchased energy, steam, heat, or cooling). For larger companies, the proposal also called for the requirement of certain scope 3 emissions (all indirect emissions, not included in scope 2, that occur in the value chain, upstream and downstream) if they are material or if the company had a scope 3 reduction target.

The original proposal certainly ruffled feathers. It was quite possibly the first domino to fall in a chain that resulted in vicious environmental, social, and governance (ESG) backlash across the US. More specifically, it was the scope 3 requirement that was most contentious and that’s understandable. For many companies, the rule would affect the value chain, which:

- Is difficult to measure, requiring a tremendous amount of resources – time, effort, and, you guessed it, money.

- Lacks a consistent methodology for accounting.

Number two above isn’t entirely correct, although it has been a key talking point for critics. The Greenhouse Gas Protocol standards have provided this methodology since 2011. In fact, the calculation guidance is the only internationally accepted method for companies to account for these types of value chain emissions. For financial institutions, the Partnership for Carbon Accounting Financials (PCAF) also released guidance in 2019/20.

Despite these resources, critics were exceptionally vocal.

Implementation Date:

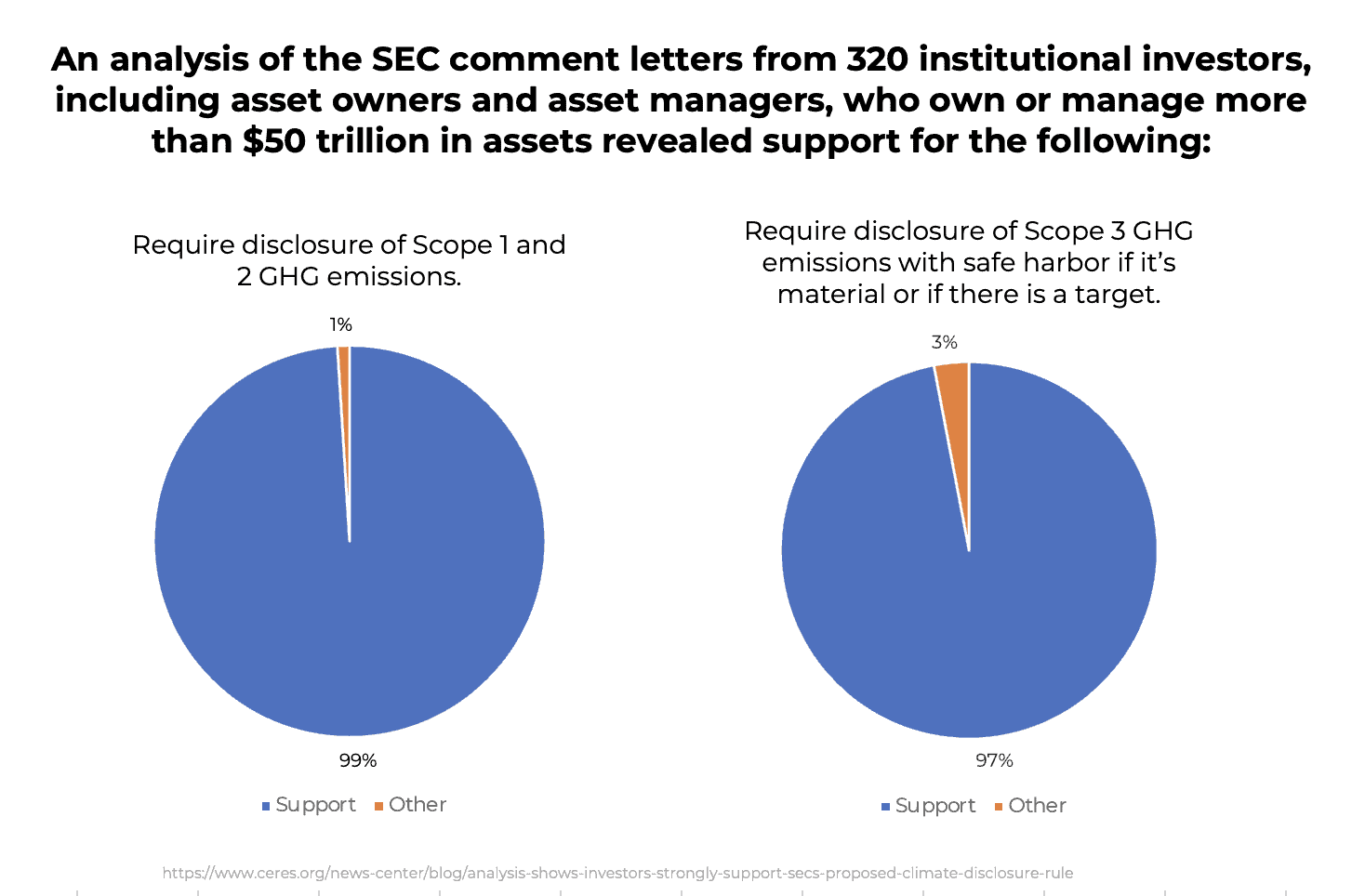

Here we are, a year and change after the initial proposal, and still no directive. It’s been speculated that SEC Commissioner, Gary Gensler, is considering scaling back the rule due to intense corporate opposition. Although, an analysis shows that investors are generally supportive of the disclosure rule.

Another reason for the delay according to recent reports is concern over the number of lawsuits expected to challenge the rule, especially in light of the Supreme Court case, West Virginia v. EPA.

Regardless of whether or not scope 3 is part of the rule, lawsuits will come, and from what we can tell, they will falter. After all, as Gensler has said,

“Investors are using this information now, and they want the information. And I think it does fit into our 80- or 90-year history of how we do disclosures.…We have a role to ensure that there is not only investor protection, but, as the law said, fair dealing that the actual disclosures are not misleading.”

So, when does this go into effect? An early SEC agenda led many to believe October 2022 would be the date. But, in March 2023, Gensler said it typically takes 12 to 15 months to finalize regulations after they are proposed. With that logic, June 2023 will mark 15 months, but on April 28 it was reported that the rule had been pushed back until fall.

What To Do:

Don’t play wait and see.

It doesn’t matter if you are a large company or a smaller player within the value chain. According to a Workovia/PwC report, companies are not waiting for the SEC’s final rule to move ahead. This is because of two key reasons:

1. Change is Afoot

The longest-running criticism of ESG/sustainability reporting has been the number of frameworks and inconsistencies for the comparability of data. Not anymore. While several frameworks still exist, there are two clear frontrunners – GRI and ISSB (which are carrying on the SASB standards).

Both cater to different objectives of the two-pillar sustainability reporting system: how is the company impacting the environment and societies around them, and how are these externalities impacting the company, particularly from a financial performance perspective?

Both standards call for scope 3, and so does the EU’s new Corporate Sustainability Reporting Directive (CSRD). What’s more is, GRI and ISSB plan to release guidance on how they influence the other and can be used together in June – coincidence? (Yes, probably. But it will be interesting to see how much or how little the SEC rule aligns).

2. Cost

According to the Workiva/PwC survey, 61% of business leaders anticipate that the cost of complying with the new climate disclosure rule will exceed $750,000, while 27% predict that they will spend more than $1 million. This contrasts with the SEC’s estimate that the cost of compliance for businesses would be $640,000 in the first year.

Any number you choose, it’s a lot. And to be frank, for most firms, it will not come close to those numbers. But, it doesn’t have to be a punch to the gut. By chipping away, companies can put themselves in the best position to measure, disclose, and spread the costs out over time.

How to Start?:

If you sit within the value chain, it is only a matter of time before your customers are asking for climate and other ESG information. Climate accounting and reporting are the most cumbersome in the ESG matrix. So, while it’s top of mind, it also makes sense to get a handle on the other ESG issues material to your business.

It starts with a materiality assessment. It doesn’t matter where you are in your sustainability journey – whether you’ve had things in place for years or haven’t started – we meet you where you are.

We will guide you through your strategy, what metrics you should be tracking, and execute on publishing investor-grade reporting and other communications initiatives central to this growing interest among stakeholders.